Learning about stocks and Investing

When assessing domestic stock shared funds, you’ve likely stumble upon two labels which may be confusing: Growth Funds and price Funds. Both forms of funds seek to supply the perfect returns. The difference is within the approach they just take, how they choose shares, as well as the types of markets for which they're suitable.

Growth trading

Development resources give attention to businesses that supervisors think will experience faster than typical growth as measured by profits, earnings, or cashflow. Development fund managers in addition look very carefully at means a company handles its business. As an example, numerous growth-oriented organizations may reinvest profits in expansion projects or acquisitions, without use them to pay out dividends to investors.

While development resources are anticipated to own possibility of greater comes back, additionally they generally represent a greater danger in comparison with worth funds. They tend to complete better than the entire marketplace whenever stock rates in general are increasing, while underperforming industry as stock rates fall, taking into account that past overall performance cannot guarantee future outcomes. As a result, purchasing development resources may need a slightly greater tolerance for threat, along with a longer period horizon.

Value investing

The goal of value funds is to look for proverbial diamonds when you look at the harsh; this is certainly, companies whose stock prices don’t fundamentally mirror their fundamental well worth. The causes for those stocks being undervalued because of the market can vary. Occasionally a business or business features dropped on crisis. Other times a poor quarterly earnings report or some additional event can temporarily depress a company’s stock cost and produce a longer-term buying possibility. In looking for these businesses, managers try to find what numerous professionals call a "margin of protection." This means that the marketplace has reduced a security significantly more than it will have hence its marketplace price, the purchase price of which it's trading, is lower than its intrinsic value, today's worth of its future cash flows. One example will be a stock which investing at $90, but whose intrinsic price is $100.

In general, worth funds focus on sensed security in place of growth, frequently investing in mature businesses which are mainly employing their earnings to pay dividends. Thus, worth resources tend to produce more present earnings than growth funds, although they in addition offer the prospect of long-term admiration in the event that marketplace recognizes the real value of the shares for which they spend.

Growth vs. worth - a quick reference

|

Development resources |

Worth resources |

|

|---|---|---|

|

Attributes |

Consider organizations with above normal rates of development in earnings and product sales. These shares tend to have above-market price-to-earnings and price-to-sales ratios, given that rapidly developing sales and earnings justifies a higher-than-average valuation. |

Focus on businesses with lower-than-average product sales and profits growth prices. Holdings generally speaking function shares with reduced price-to-earnings and price-to-book ratios. Shares generally speaking have actually greater dividend yields. Fund can potentially take advantage of turnaround circumstances. |

|

Risks |

Development may not continually be recognized. Price-to-earnings or price-to-book ratios may decrease due to unexpected activities. |

Market could have properly listed underlying companies, in which particular case they could never understand their particular intrinsic worth. |

Are there funds that offer a little of both?

Resources that invest in both growth and price stocks are known as mixed resources. Blended funds tend to exhibit many of the characteristics of both growth and value funds—potential for capital appreciation, current income, low price/earnings ratios, as well as stocks that often reinvest revenues back into business operations. Numerous managers of blended funds pursue a method known as development at an acceptable Price (GARP). Managers of the funds usually focus on growing organizations, but they are also very price aware paying close awareness of standard price signs like the price-to-sales, price-to-earnings, and price-to-growth ratios assuring they are reasonable.

Think about market capitalization?

There’s one kind of investment category that individuals haven’t talked about: marketplace capitalization, or market cap. This term simply describes the size of the companies where fund spends, as calculated because of the total worth of all its outstanding stocks. For-instance, large-cap funds generally purchase companies whoever total share price exceeds $10 billion, mid-cap resources spend money on organizations with a complete share value of between $2 billion and ten dollars billion, and small-cap funds concentrate on businesses whoever complete outstanding stocks tend to be valued at less than $2 billion.

Utilising the design field to put all of it together

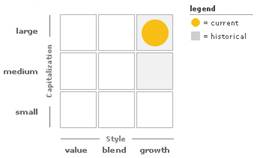

Now you comprehend the principles of trading design and marketplace capitalization, you can use the Fidelity StyleMap with Morningstar® data to rapidly classify a fund. Using a combination of present and historical Morningstar data, the style box categorizes a fund, providing you a simple concept of the possibility risks included. For instance, the map below identifies a large-cap development fund.

Examining this matrix, you’ll observe that you can find nine standard kinds of stock funds. These are described below

Huge value funds

Mainly invest in organizations with marketplace values more than $10 billion that investment supervisors think happen undervalued by the marketplace. Worth can be decided by multiple steps, including price-to-earnings proportion, price-to-book proportion, or dividend yield.

Huge combination resources

Primarily invest in organizations with market values greater than $10 billion. These funds spend money on a combination of growth and value-oriented shares.

Large growth resources

Primarily invest in companies with market values greater than $10 billion that fund managers believe are poised for growth. Growth is centered on multiple facets, like revenue or profits growth.Growth resources are usually focused on producing capital gains in place of earnings.