Learn about stocks and Investing

It’s a running joke for brand name loyalists: If you spend that a lot on a company’s coffee, clothing or cereal, you could besides invest in the stock.

But as soon as you’ve seen the number close to that brand’s ticker sign creep up for very long enough, you are prepared for the joke to make severe. All things considered, thinking in a business, its services and products and its lucrative future can be as good grounds as any to buy that company’s stock.

Beyond the why, however, there’s the exactly how: how will you in fact spend money on stocks? How much money does it require? How can you limit risk as a newbie trader?

To answer these concerns, let’s study the essential steps involved with purchasing shares.

1. Understand your choices

There are many how to invest in stocks. But for most investors, we advice two:

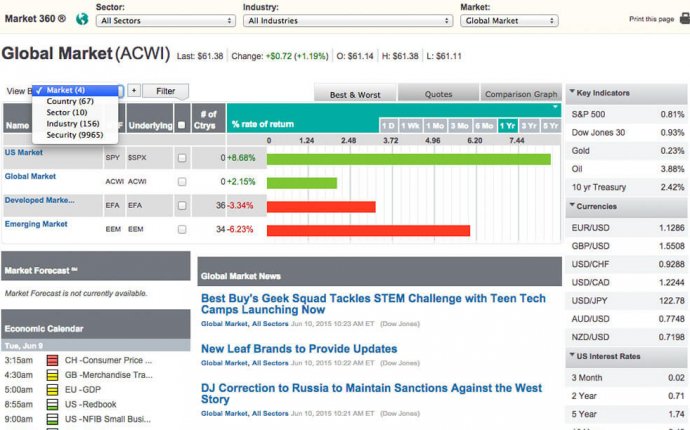

- Equity list resources or exchange-traded funds. These resources permit you to purchase little items of a variety of stocks in one exchange. Index resources and ETFs track an index; for example, a Standard & Poor’s 500 fund replicates that list by purchasing the stock of companies on it. When you purchase the investment, in addition have little pieces of those businesses. You'll put a few resources collectively to construct a diversified portfolio.

- Specific shares. If you’re after a specific organization, you can aquire one share or some stocks in an effort to drop your toe into the stock-trading seas. Building a diversified portfolio away from numerous specific stocks is achievable, nonetheless it would simply take an important investment.

» CONSIDERABLY: Should I purchase shares, ETFs or shared funds?

2. Pick an account

If you are taking part in a workplace pension plan like a 401(k), you'll already be dedicated to stocks, albeit through resources like people described above. Most employer-sponsored your retirement programs don’t offer individuals accessibility individual stocks.

In the event that you don’t have a 401(k) or you discover its investment choices lacking, you can make use of an internet broker purchasing shares, resources and multiple other assets. With a broker, it is possible to open an individual retirement account like a traditional or Roth IRA — that'll enable you to scratch your stock-buying itch while trading for your retirement — you can also open a taxable brokerage account if you’re currently squared away for retirement.

If you’re starting a unique account, consider agents having reduced charges and reasonable account minimums. Many of those one of several best agents for newbies, including TD Ameritrade and OptionsHouse, need no minimum deposit. Most agents provide a list of commission-free ETFs or no-transaction-fee list and shared funds, which will permit you to prevent a charge each time you buy or sell. With specific shares, you will probably spend $5 to ten dollars per stock trade depending on the broker, though you will find no-cost solutions like applications Robinhood or Loyal3.

Then think about the research that’s available through each broker, alongside its support, educational resources and trading and investing systems. As a newbie, it is possible to purchase the stock through internet based broker’s website, however if you intend to nurture this practice, you might graduate to a more advanced system.

NerdWallet’s brokerage search tool can help you sort through the choices:

3. Determine your financial allowance

There's two concerns in this process: how much cash do you want in order to spend money on stocks? And how much money in case you spend money on shares? Typically, the email address details are various.

The money you'll need so that you can purchase shares is dependent upon how costly the shares are and just how much cash you have to have fun with. However if you have got Champagne tastes and a finite pool of income, Loyal3 offers fractional stocks — items of expensive stocks like Alphabet or Netflix.

If you would like funds while having a small budget, ETFs can be your best wager. Mutual funds and list resources have minimums of $1, 000 or even more, but ETFs trade like a stock, and that means you purchase them for a share price without a fund minimal. That share price might be ten dollars regarding very low side and $100 or higher from the higher end.

For exactly how much you really need to invest: If you’re investing through funds — have actually we pointed out this really is our preference? — it is possible to allocate a reasonably large percentage of your portfolio toward stock resources, especially if you have quite a while horizon. A 30-year-old investing for pension could have 80% of his / her profile in stock funds; the rest would be in-bond resources.

Individual shares tend to be another tale. We’d suggest maintaining these to 10percent or less of your financial investment profile. That’s because trading in individual shares carries even more threat — it doesn’t have the integrated diversification of a fund — and much more hands-on effort. Those stock tickers don’t constantly continue on an upward trajectory — simply ask Enron’s people.

» MORE: Simple tips to invest $500

4. Research thoroughly

Scientific studies are key to investing in individual shares. You can’t predict the marketplace, you could do whenever you can to guide your portfolio toward anticipated high-achievers. Which means researching past performance, analyst ranks, current news out of the business and annual reports. This information should be offered through your broker’s web site.

With ETFs or list funds, looking into an individual fund’s overall performance is less important than understanding its costs and whether the investment fulfills your spending needs. Mainly because resources replicate a stock index, their performance will align closely with this standard, and funds monitoring similar benchmark should almost reflect each other.

Your task is figure out what variety of resources — and underlying those funds, stocks — you want within profile. If you want to hold big U.S. organizations, you may well be attracted to S&P 500 list funds. If you need tiny businesses, you could evaluate Russell 2000 resources.

Then you can certainly compare resources that track equivalent standard by their particular costs, which will lower returns. Each investment will obviously list its expenditure ratio — the portion of your financial investment that goes toward the fund’s yearly running expenses. Aim to keep that quantity under 0.25per cent, though it might extend higher for niche funds.

» GREATER: Learning financial investment fees

5. Gather your nerve

Remember four terms: stay glued to the plan. This is potentially the toughest component about investing, and especially purchasing individual stocks. Anticipate to see huge swings when you look at the share cost linked with company news, general marketplace turmoil and who knows just what else.

Investing is mental. It’s all too very easy to panic and grab at wrong time or get embroiled in a rally and spend over you really can afford with what feels as though a winner. But it’s crucial that you remain the course, if you have actually a long-term plan you're feeling good about.

Meaning knowing how a great deal you wish to spend at exactly what cost, and just how far you’re ready to let a stock fall before you offer. These kinds of rules, as well as choosing the right order type when you place a trade, will limit your risk and help you fight back against emotional responses. And when you discover you’re nonetheless also vunerable to a knee-jerk effect? You can find always those equity list funds and ETFs.