Best books to read about stock Investing

+ READ ARTICLE

State you would like a crash course on everything you need to realize about investing. In the event the goal is simply to setup a pension plan and move on, it is hard to improve from the fundamental advice University of Chicago teacher Harold Pollack cleverly squeezed onto one index card. (It boils down to save your self a great deal and get low-cost index funds.) For a deep dive into fundamental stock evaluation, alternatively, you’d simply take a crack at Benjamin Graham’s dense but satisfying The Intelligent Investor.

The majority of us, though, live approximately those poles: We’re very happy to outsource most stock selecting to a shared investment manager, but we feel compelled to concentrate on the markets—especially at a time such as this, whenever equities tend to be racking up record highs.

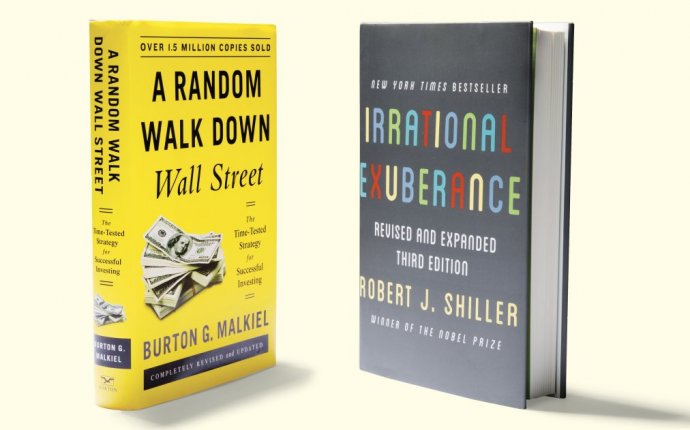

If it feels like you, then two volumes you'll need are A Random Walk Down Wall Street by Burton Malkiel and Irrational Exuberance by Robert Shiller. Both tend to be classics which were republished this current year in brand new editions addressing today’s marketplace.

Today, I should admit here this suggestion is a little devious, since these two publications disagree on a pretty fundamental point. Essentially, Random Walk argues that the hive mind of the marketplace is brilliant at determining the fair price for a stock that there’s little part of wanting to second-guess it. Irrational Exuberance, at the same time, shows that stock costs occasionally have insanely large or reduced, and that you’d be similarly crazy to not realize that. Frustratingly, both publications make effective cases.

But learning to wrestle with ambiguity and anxiety is great psychological education for purchasing stocks, which is never ever likely to be a cushty knowledge. Through the 2007 to 2009 bear market, after all, perhaps the basic vanilla Vanguard 500 Index investment dropped by above 50per cent. That said, these books don’t just argue two sides of an essential and interesting debate. Taken together, their particular ideas makes it possible to build a smarter, less dangerous financial plan.

Embracing Randomness

Malkiel is an emeritus professor at Princeton, but his guide, first published in 1973, is certainly not a scholastic tome. Rather, it’s a how-to help guide to creating a balanced, diversified portfolio, preferably with low-cost list resources. As you go along, however, he popularizes some big, hairy ideas. Most important: the “random walk” of stock prices, in addition to efficient-markets hypothesis.

The concept that stock rates wander randomly does not mean they don’t add up, but that they’re very hard to predict. For several useful reasons, tomorrow’s cost might as well be random. Last moves up or down won’t let you know a great deal. More controversially, neither will a company’s earnings statement or balance sheet. Why-not? Because if you could actually make use of these types of information to predict in which a stock ended up being headed, various other people would’ve done it, plus the cost could be there now. In that way, today’s costs aren’t random anyway but, inside jargon, efficient, because they already include the information you can aspire to know.

Random Walk assisted make famous a vintage joke in regards to the economist who wouldn’t pick-up a $100 costs in the street, reasoning that if it had been truly truth be told there somebody else would have taken it. “A much better variation, ” Malkiel adds, “would be to consider when any $100 expenses tend to be lying around, they will not be there for very long.” Another person will more often than not snap them up before you decide to occur to walk by.