Share market for Beginners Tutorial

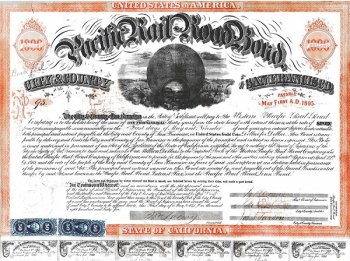

Long before there have been corporations that issued stocks of stock for financial investment, there is the organized use of debt to boost money. Financial obligation involves borrowing cash with the promise to pay it back full, along side interest eventually. The guaranty ensuring that promise is called a bond. Simply put, bonds represent debt burden.

Long before there have been corporations that issued stocks of stock for financial investment, there is the organized use of debt to boost money. Financial obligation involves borrowing cash with the promise to pay it back full, along side interest eventually. The guaranty ensuring that promise is called a bond. Simply put, bonds represent debt burden.

Bonds have been around for millennia. The ancient Mesopotomia city of Ur in what is these days Iraq had a bond market around 2400 B.C., guaranteeing repayment for lent grain. Kings, and later democratic governments often borrowed by providing bonds to invest in wars and territorial development. In our contemporary world, governing bodies however borrow to undertake jobs, but there is however also a thriving marketplace for bonds released by corporations, who borrow for broadening profitable undertakings. Including, a business may borrow being acquire a competitor, to construct a unique factory, or to hire personnel.

Bonds are fundamentally distinct from stocks in several means. Stocks of stock represent statements on profits and confer voting legal rights to shareholders additionally the price of stocks hence vary with expectations of future profitability for company. Bonds, having said that, represent debt repayment obligations and are also listed centered on factors for instance the odds of becoming paid back.

When you look at the contemporary economic climate, most diversified financial investment profiles contain some allocation each to stocks and bonds, in which bonds in many cases are considered the greater amount of conservative selection of the two. For many explanations which is discussed in this tutorial, bonds do offer some safeguards that stocks of stock shortage.

This tutorial will hopefully help you realize bonds, and determine whether or otherwise not bonds tend to be right for you. We'll introduce you to the basic principles of what bonds are, the various kinds of bonds and their crucial qualities, how they behave, tips purchase them, plus.