Share market for Beginners PDF

Stock marketplace anomalies act in mystical means. Over-long durations they can supply anticipated outperformance versus passive indexes, in the short run they may be able encounter bouts of gut-wrenching underperformance (e.g., ).

Stock marketplace anomalies act in mystical means. Over-long durations they can supply anticipated outperformance versus passive indexes, in the short run they may be able encounter bouts of gut-wrenching underperformance (e.g., ).

Just what accounts for this sporadic overall performance and these tantrum-like swings? Much like other tough questions, educational research has provided some insights. Current research implies that trader “performance chasing” may play a role. We've discussed facets of performance chasing, and how it gives increase toward “investor return gap, ” (discussed here) wherein people capture on their own in the foot by attempting to efficiently “time” inside and out of methods.

A unique type of analysis stretches this evaluation in some fascinating means.

Do Smart-money and Dumb Cash Flows Drive the Anomalies?

- Does “dumb money, ” that is performance chasing, drive costs away from fundamental value, and

- Does “smart money, ” drive prices back towards fundamental value?

The writers investigate investment flows for shared resources, which is believed becoming foolish cash, and hedge resources, which can be assumed becoming smart money, and just how these investment moves connect with the ebb and circulation of currency markets mispricing.

They test their theory by setting-up a research.

- Very first, they establish a proxy for mispricing, to determine whether mispricing generally is high, or reduced.

- Next, they measure general investment moves to shared resources and hedge resources.

- Eventually, they study the connection between noticed stock exchange mispricing and these investment moves.

How do they Gauging Mispricing?

To be able to construct a proxy for cross-sectional mispricing, the writers make use of a way set up by Stambaugh, Yu and Yuan, which will be considering 11 variables that predict stock market comes back after managing for alleged danger facets (age.g., 3-factor Fama French model):

- Return on Assets, O-Score, Failure Possibility, Gross Profitability, Net Stock Problems, Accruals, Composite Equity Issues, Investment-to-Assets, Web Running Possessions, Resource Development, and Momentum.

This composite associated with the anomalies serves as a proxy for aggregate mispricing. When aggregate mispricing is being corrected, a hedged strategy (long undervalued shares and brief overvalued stocks) should create positive returns, as rates move towards fundamentals. By comparison, when stock rates further go away from fundamental price, cross-sectional mispricing gets to be more intense and a hedged strategy creates bad comes back.

The sample includes stocks listed on the NYSE, AMEX and Nasdaq (excluding stocks < $5/sh), and addresses the period January 1994 through December 2012.

How Do They Measure Fund Flows

Shared investment flows tend to be measured using data from the CRSP Survivor-Bias-Free United States Mutual Fund database. The test includes > 1.5 million fund-month findings. Hedge fund flows are calculated utilizing information through the Lipper TASS database. The test includes > 250K fund-month observations.

So what does evidence State?

Panel A (below) reveals the connection between aggregate shared investment (foolish cash) moves and comes back to your individual anomalies. As a whole, there clearly was a bad relationship between anomaly return and “dumb cash” flows. So a rise in mutual investment moves leads to contemporaneously lower anomaly returns.

Keep in mind that anomalies one through six (and 11) are considerable and share an intriguing common feature: all of them relate genuinely to growth investing!

- Low ROA: large assets relative to earnings is an improvement trading concept

- Tall O-Score: greater influence and higher market-to-book multiples represent growth investing

- High Failure possibility: again, greater leverage and market-to-book multiples represent development trading

- Lower Gross Profitability: lower income will tend to be of development stocks

- Tall Net inventory Issues: firms with reduced money flows count on equity offers to raise capital, and are development stocks

- Tall Accruals: shares with earnings filled by accruals are usually development shares

Development stocks tend to be described as high present earnings growth, and growth people extrapolate this past overall performance, and anticipate it to keep in the foreseeable future (an idea investigated by Lakonishok Shleifer and Vishny, once we discuss right here). Sadly for growth investors, this is often not a good analytical wager, simply because they have a tendency to overpay for future growth that isn't understood, once we discuss right here.

The energy email address details are quite strange, as you would intuitively anticipate that shared fund flows could be positive for momentum strategies. Possibly there is a disposition impact in play (see Frazzini’s paper right here)?

The writers mention that things 7 through 10 mirror “real investment” which their investment flows try not to appear to exacerbate mispricing within these anomalies.

Do Shared Fund Flows Deepen Mispricing?

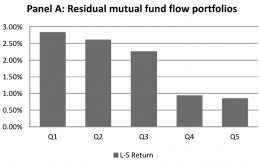

The chart below highlights the long/short comes back for an equal-weight basket of anomaly portfolios, sorted by quintiles of residual shared investment flows. Quintile 1 signifies L/S comes back when residual shared investment flows are reasonable, while quintile 5 signifies L/S returns whenever residual shared fund flows tend to be large.

The outcomes tend to be hypothetical results as they are NOT an indication of future outcomes nor represent comes back that any buyer really achieved. Indexes are unmanaged, usually do not reflect management or trading costs, and another cannot invest right in an index. Extra information in connection with building among these results can be obtained upon demand.Exactly what do you realy observe?

Our L/S return series is large when mutual fund flows are reasonable, and L/S returns tend to be reduced when mutual fund flows are large. Recall from “How to measuring mispricing?” above that after mutual fund flows tend to be greater, the L/S methods creates unfavorable comes back. Do you know the levels of residual mutual investment moves when our L/S does poorly? They have been large. More over, the writers examine the long and short elements separately, and discover that shared investment flows are notably about the brief leg, suggesting that shared resources accentuate mispricing of already overvalued stocks.

Shared fund moves exacerbate cross-sectional mispricing across the growth measurement. When retail people chase overall performance, allocating to growth resources that have done really, overvalued shares held in those funds at the start of the month be overvalued by the end associated with the month. When new performance chasing capital is allocated to these shared resources, the managers invest these brand-new flows into the shares they currently very own. The costs of the stocks after that experience a reversal throughout the next a couple of months.