Best investment Sites for Beginners

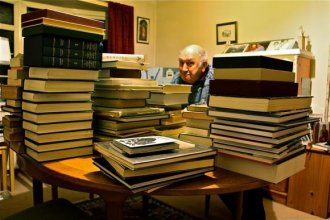

Listed below are just a few of numerous great publications that make you savvier and improve your likelihood of trading profitably:

You may get a great grounding via books such as for instance by David and Tom Gardner (our Motley Fool books); by Burton G. Malkiel and Charles D. Ellis; and also the classic, by Peter Lynch.

The seminal by Philip A. Fisher takes you slightly more along.

John Bogle, the father of list funds, has many solid choices, too, covering mutual funds and investing in general: and

That final book is part of an excellent number of "Little" (and quick!) books which cover many different crucial investing subjects. Other people that could be helpful to brand-new investors consist of by Joel Greenblatt, by Charles B. Carlson, by Christopher H. Browne.

Spend money on list funds

When you feel fairly comfortable about investing, you can start committing some bucks. A good way for many people to begin has been list funds - which includes both shared funds and exchange-traded resources built to track and really replicate the performance of specific indexes. List resources are now actually ideal for almost all investors. It really is challenging outperform the entire marketplace consistently, generally thereisn' pity in only keeping low-cost index funds. Broad-market people are ideal, like the SPDR S&P 500 ETF, Vanguard complete stock exchange ETF, and Vanguard complete World Stock ETF, providing, correspondingly, the largest 80percent of U.S. marketplace, the whole U.S. marketplace, or just about every one of the planet's stock market.

spend money on specific stocks

spend money on specific stocks

Finally, you can look at buying individual shares. It is possible to just stick to list funds, but if you need the opportunity to outperform all of them, you can try. This is where having read a lot of the books above many other individuals, as well, shall help you much more. You need enough time and interest to research and follow some organizations, and yourself have to have created some stock evaluation skills.

Without considerable stock feeling, you could jump into a high-dividend stock, not realizing that its dividend is high since it's already been falling. Or perhaps you might get a stock since you love the company's possible, without recognizing that it's maybe not yet lucrative, or perhaps is saddled with crippling financial obligation.

Starting investors - and all people, really - should adhere to businesses they understand and realize, or can understand and realize. Dividend payers tend to be a good idea, because their dividend payouts could be especially welcome should the stock or market just take a temporary spill.

If you are looking for dividend-paying shares, go ahead and look for solid yields - say, 2% or higher - but be skeptical of extremely high ones, such as 7percent or 10% yields. They could be linked with organizations being struggling, in which particular case the payouts could possibly be paid down or suspended. Choose solid dividend growth during the past few years, too, as that will make a 2.5per cent yield way more appealing than a 4per cent one that isn't prone to grow much.

And assess the payout proportion, also. It's the result of dividing the yearly dividend amount by the this past year's worth of earnings per share. A low payout proportion - say, below 50% - reflects loads of area for development, while a steep one - state, 80percent or maybe more - is less attractive. And lastly, learn adequate concerning the business to be confident of its future. It must have durable competitive advantages (eg a stronger brand name or economies of scale), and healthier financial statements (a lot of money, powerful and developing income, minimal financial obligation, etc.).

By investing in debt training and list resources - while you would like, specific shares - you will get to an excellent come from the investing world, and can begin to build an improved future on your own.

Longtime Fool specialist doesn't have position in any stocks mentioned. The Motley Fool does not have any place in any associated with stocks talked about. Take to some of our silly publication services no-cost for 1 month. We Fools may not all contain the same viewpoints, but all of us believe that considering a diverse range of ideas makes us much better investors. The Motley Fool has actually a disclosure policy.