Best stock books for Beginners

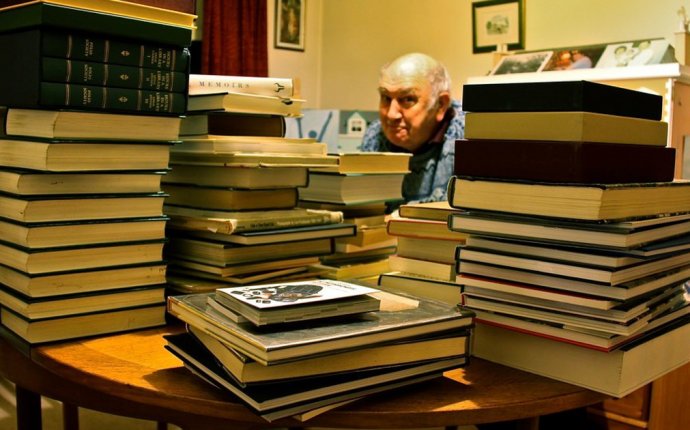

Generally, the essential effective people on earth are also voracious visitors. This is also true quite successful worth investors.

Generally, the essential effective people on earth are also voracious visitors. This is also true quite successful worth investors.

Both Warren Buffett (whom accustomed read 1, 000 pages every day when he was beginning) and Charlie Munger (just who often recommends young people to “develop into a lifelong self-learners through voracious reading”) credit their particular practice of reading as a major contributor with their success. Ben Graham was an even more prolific reader than his successors – however regularly quote the Latin and Greek classics and when translated a Spanish novel into English.

Hopefully, I’ve persuaded you how crucial it's to see and learn, especially if you are new to investing. Fortunately, I’ve compiled a listing simply for you (don’t worry, you won’t must convert such a thing from Spanish).

by Benjamin Graham

In the event that you only ever review one financial investment book, after that let it function as Intelligent Investor by Benjamin Graham. There’s grounds why Graham is named the “Godfather of Value Investing.” Benjamin Graham was essentially the most influential trading figure of the twentieth century, in addition to Intelligent Investor is probably the most influential investment guide ever. The smart Investor is the price investor’s bible… keep this on your own bedside dining table.

The smart Investor is the price investor’s bible… keep this on your own bedside dining table.

by Lawrence Cunningham (Editor), Warren Buffett

If Intelligent Investor may be the value investor’s bible, then Essays of Warren Buffett would be the price investor’s New-Testament. Warren Buffett is writing essays on trading and company for 50 years, along with his genius – along with their down-to-earth charm and obvious prose – makes him possibly one of the greatest educators in addition to one of the best people to own previously lived. A majority of these essays are found for free online, nevertheless the Essays of Warren Buffett by Lawrence Cunningham brings all of them together under one roof.

by Bruce Greenwald, Jude Kahn, Paul Sonkin, & Michael van Biema

Bruce Greenwald could be the Robert Heilbrunn Professor of Finance and resource control at Columbia University and is one of several leading authorities on worth investing. This book provides many extensive breakdown of price investing of any investment book I’ve read, addressing basic methods of worth investing also profiles of effective price people such as for example Warren Buffett and Mario Gabelli.

by John C. Bogle

Investing is all about wise practice. Possessing a diversified portfolio of stocks and keeping it the future is a winner’s online game. Wanting to defeat the stock market is in theory a zero-sum online game (for virtually any winner, there should be a loser), but following the significant prices of investing are deducted, it becomes a loser’s online game. John C. (“Jack”) Bogle is the creator for the Vanguard Group and creator of world’s first index fund, as well as the minimal Book of good judgment Investing is a premier recommendation of Warren Buffett’s. There’s really a funny tale that after Jack Bogle initially came across Warren Buffett, Jack recognized Warren, moved up-and introduced himself, in which he thought to Warren, “you understand the thing i like about yourself is you have rumpled matches likewise as I do” – and Jack and Warren have been friends ever since.

There’s really a funny tale that after Jack Bogle initially came across Warren Buffett, Jack recognized Warren, moved up-and introduced himself, in which he thought to Warren, “you understand the thing i like about yourself is you have rumpled matches likewise as I do” – and Jack and Warren have been friends ever since.

by Peter Lynch

Peter Lynch is one of the most effective investors ever before – from 1997 to 1990, his Magellan Fund averaged a 29.2percent mixture annual return. In one single upon Wall Street, Peter Lynch describes how average investors can defeat the professionals by making use of whatever they know. In accordance with Lynch, financial investment options tend to be every where: through the grocery store into office, we encounter services all day long. By paying awareness of the greatest ones, we can get a hold of companies where to invest ahead of the expert analysts discover them.

by Michael Porter

Learning Michael Porter is just one of the very first things you do running a business college. Competitive method by Michael Porter has transformed the idea, rehearse, and teaching of business strategy across the world. This book presents Porter’s 5 causes to greatly help investors evaluate business attractiveness, along with the 3 types of a company’s strategy – cheap, differentiation, and concentrate.