Stock Trading School New York

Walker and Walker—Getty Images

Walker and Walker—Getty Images

Now that senior school senior Mohammed Islam has accepted to New York Observer editor (and previous MONEY columnist) Ken Kurson which he completely constructed that entire stock-trading boy-genius gazillionaire tale, the Twittersphere is condemning nyc magazine (and writer Jessica Pressler) for just what's believed to be careless fact-checking.

There isn't any doubt that the situation is awkward, and that the still-posted article - a portion of the mag's "reasons why you should Love ny" function that currently experienced a headline modification Monday ("Because a Stuyvesant Senior Made $72 Million stock trading ..." became "Because a Stuyvesant Senior Made many Picking Stocks ...") - will have to be corrected further.

It now seems that there are no millions. Maybe not the reported 72. None.

Nevertheless, there's a disagreement that Pressler and ny are not solely culpable for yesterday's news circus. Let's not pretend: Many when you look at the news who covered and disseminated this story (including, albeit extremely skeptically, MONEY) tend to be New York-based news types, proud of our city and its if-you-can-make-it-here-you-can-make-it-anywhere mythology.

Taken at its word, the story believed like an ode to no-cost areas while the United states fantasy. From hobbyists to specialists, people are thrilled because of the indisputable fact that with enough smarts and hard work anybody can go from towels to riches, no matter where they begin. If an industrious first-generation American can develop a huge lot of money involving the age of 9 and 17, you can easily too, appropriate?

There is a term for this impulse, in reality: "confirmation bias, " which can be exactly what specialists call the most popular peoples tendency to seek out just information that verifies what we already think - or wish think.

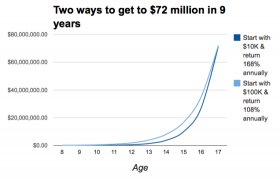

The fact is, we have to did the mathematics, since the graph and description below show.

Source: CASH computationsIn ny also journals, Islam stated he started trading using funds from tutoring while he was at center school. Their starting age was handed as either 9 or 11. Let us assume he previously started at 9, in 2006. After that let`s say he had been exceptionally industrious with his tutoring, permitting him to begin with $10, 000 in cost savings. In order to get $72 million dollars by their senior year, Islam could have needed to post normal annual comes back of 168per cent from age 9 to 17. that is staggeringly not likely.

But let's go on it more: suppose someone had spotted Islam's prodigious skill and given him $100, 000 to try out within the areas. Even he then could have needed to return on average 108per cent yearly. Which is over five times Warren Buffett's typical returns of 20per cent. And he might have had to get it done yearly for nearly 10 years.

To put it differently, Islam's tale was preposterously unlikely even if we'd provided him every one of the great things about our doubts.

Various other tales of trading prodigies have recently come out recently, including one about a fresh Jersey teen who promises he turned $10, 000 into $300, 000 trading small cap stocks, a task that will require a one-year return of almost 3, 000per cent (which will be improbable though not impossible). The reporter on that tale appears well informed inside the reality checking.