How to deal in stock market?

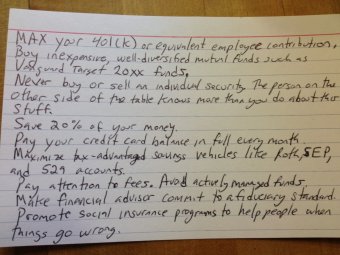

Stock rates have actually declined about 9 per cent in 2010, and it's just January. Fortunately that every little thing the standard saver must know to safely navigate the tumult into the worldwide monetary industry fits on four-by-six list card shown above.

Stock rates have actually declined about 9 per cent in 2010, and it's just January. Fortunately that every little thing the standard saver must know to safely navigate the tumult into the worldwide monetary industry fits on four-by-six list card shown above.

At any given time similar to this, this card is much more significant for what it doesn't say than what it will. You could realize that there is nothing in those 24 square inches about global collapses in stock costs.

As an alternative, the card lays out a straightforward method — point-by-point — for ordinary, Main Street people to follow along with through most of the economy's good and the bad.

This means, stand by sound spending principles and withstand the temptation to stress and offer, suggested Harold Pollack, an expert on private finance (among other items) in the University of Chicago.

"you shouldn't be doing such a thing different in times of financial turmoil, " Pollack said. "All the evidence is this will be a very good time to complete absolutely nothing."

Pollack may be the composer of this list card, along with a newly posted book called "The Index Card, " which he had written with journalist Helaine Olen. Wonkblog has actually covered their financial suggestions before — most recently, during summer, that was the last time stock rates plummeted.

The advice on the card, that is based on the previous few years of financial analysis in to the nature of stock markets, is quite simple.

Initially, spend less. Saving 20 per cent of money while the card instructs, is a great goal, though Pollack acknowledged it could be unrealistic for a lot of households when median family earnings being declining for 15 years.

Then, put your cost savings in records that may help you save even more money in taxes, such a Roth individual retirement arrangement or a 529 account for college tuition.

As soon as your cash is in those records, make use of it to purchase index funds, exactly what Pollack calls a "vanilla ice-cream" way of investing easily and inexpensively in an array of shares or bonds.

With your funds, your opportunities will gain and periodically shed worth at approximately similar price because will the market as a whole.

Do not test this yourself

Some savers should you will need to improve comes back by reading the stock pages in report, enjoying economic development on cable tv and selecting the businesses they believe are likely to prosper. Or they might make an effort to defeat the marketplace by purchasing when they think prices are rising and selling when, like now, things begin to look bad.

Mathematically, this type of person almost certain to fail. You might not be delighted when, for many savers this thirty days, your declaration from the lender is covered in red ink. Truth be told, though, it really is very hard to complete much better yourself.

To understand why, think of how the areas work. Huge finance institutions tend to be staffed by individuals who spend-all time considering if the cost of a stock or a bond precisely reflects simply how much it really is well worth.

If the folks at one organization believe a particular company has actually hard times forward, they are going to sell that company's stock. If folks at various other finance institutions agree, they are going to offer the stock, too, and they'll bid the purchase price down.

Alternatively, if things searching for up, the individuals at those financial institutions will choose the stock, and price will rise. Because of this, at any moment in time, the buying price of a stock represents the opinion of legions of fiscal experts on how much the business is really worth.

If you are probably buy or sell, you had better make sure to know anything dozens of men and women don't.

"marketplace costs are basically dependant on the collective activity of a really multitude of extremely advanced people, for whom that is their regular task, " Pollack stated.

That's true even though costs are plummeting. "while selling away, you may be basically saying, 'i really believe your stock market is worth under most of these others still find it, '" he included.

Do not be a hero

There could be a few people available to you who will be effective at regularly beating industry. (you-know-who you may be.) As a matter of arithmetic, though, there can't be too many of them. If there were, their particular choices about what as soon as buying and sell would start to influence rates in a single direction or even the various other.

As for the sleep people: Don't try to be a hero. Buy index funds.

With index resources, the buying price of your investments will occasionally fall. Over the long haul, though, they increase. That's particularly vital that you keep in mind during a collapse in rates.

"in the event that you precipitously sell, the historic record shows that you frequently skip the rebound that happens, " Pollack said. "You’re essentially offering once the marketplace is at its minimal."

"consider just what occurred to the people which sold their holdings in 2008, " Pollack added. "those individuals destroyed out on a huge run-up in stock market." Certainly, when you look at the seven many years since the stock exchange's nadir at the beginning of 2009, rates have actually doubled then some, even with this thirty days's decreases.

Occasional collapses inside stock exchange, similar to this one, tend to be more drastic compared to the bond marketplace. During the period of various years, however, the stock market has actually historically created higher comes back, significantly more than making-up for those of you losings.