Good stock market companies

With the newest launch of Glassdoor's 2016 most useful Places to get results honors, our economists decided to revisit one of our most popular scientific studies.

With the newest launch of Glassdoor's 2016 most useful Places to get results honors, our economists decided to revisit one of our most popular scientific studies.

Because research, we asked a simple concern. Do shares of companies with high staff member pleasure outperform the market? To resolve that concern, we then followed a few portfolios of ideal Places to get results award champions over the years and analyzed their overall performance resistant to the S&P 500.

The conclusions had been striking. Regardless of how we looked at the figures, Best Places to the office champions were also great financial opportunities. Portfolios of companies with satisfied employees outperformed the overall market in five of the six years we examined, beating the return on the S&P 500 by as much as 122 percent between 2009 and 2014.

Looking Right Back at 2015

With another year behind us, we looked over the way the 2015 most useful locations to focus winners-announced in December 2014-fared against the general market. It is no surprise 2015 comes back have been lower than in recent years, but there is nevertheless a significant outperformance of an equally weighted portfolio for the 23 public 2015 most readily useful Places to operate businesses.

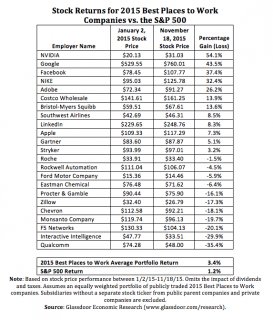

The total marketplace was essentially flat in 2015, utilizing the S&P 500 earning only 1.2 per cent through November 18, 2015. By comparison, our portfolio of 2015 Best Places be effective winners would have won 3.4 per cent if bought in January-2.8 times the return of the overall market.

The total marketplace was essentially flat in 2015, utilizing the S&P 500 earning only 1.2 per cent through November 18, 2015. By comparison, our portfolio of 2015 Best Places be effective winners would have won 3.4 per cent if bought in January-2.8 times the return of the overall market.

Some Details

Listed here is how we stumbled on that conclusion. One of the 50 large winners of this past year's honor, we examined the 23 that were openly traded for the complete 12 months (up to now) of 2015. Organizations required their own devoted stock symbolization is included-no subsidiaries that didn't have unique stock ticker and no private organizations.

Stock markets tend to be shut on new-year's time, so our analysis looks at stock performance as measured by price appreciation in daily finishing costs from January 2 through November 18 of 2015.

The dining table below programs the information associated with the 2015 Best locations to exert effort portfolio we constructed. The best performer was the aesthetic computing and graphics huge NVIDIA, which had a broad employee satisfaction rating of 3.9 regarding 5 performers and earned a scorching 54.1 per cent stock return this present year.

They may be followed closely by Google (4.5 celebrity score; 43.5 percent stock return); Twitter (4.1 celebrity score; 37.4 % stock return); NIKE (3.9 star rating; 32.4 % stock return); and Adobe (4.1 celebrity score; 26.2 percent stock return). For research, the average company score on Glassdoor among a lot more than 445, 000 companies worldwide is a 3.3 out of 5.

Overall, an equally weighted portfolio among these companies-in that you simply invest the same dollar amount in each and hold for the entire period-would have actually received a 3.4 percent return. By contrast, a diversified profile designed to match the S&P 500 might have received a 1.2 % return throughout the same duration, or just around one-third just as much.

How Can 2016 Winners Perform?

Glassdoor simply revealed its brand new batch of champions, a Places to the office in 2016, and then we wanted to observe how the winning organizations done within the last 12 months against the S&P 500. Because of the monetary performance of 2015's champions, we expected in 2010's winners to outpace the S&P 500 again.

Here is what we found. On the list of 26 openly exchanged companies regarding 2016 listing, the common stock return up to now this season ended up being 9.9 per cent. Place differently, an equally weighted portfolio of 2016 ideal Places be effective Companies-if purchased back in January-would have actually received a 9.9 per cent return. That is over eight times the return associated with the S&P 500, and dramatically a lot better than the 2015 list.

Further Reading

For lots more on the website link between worker satisfaction and economic overall performance, see our full research and accompanying blog post.