TradeKing limit order

Helpful tips to the processes and language associated with on the web stock trading.

The capability to trade shares and options online has established an innovative new world for the retail trader. Aided by the proliferation of online stock and option brokers, the age of large commissions and restricted information for retail on line dealers moved how of the buggy whip.

Ahead of the development of web trading, the main method to investigate a stock was to you will need to press the information and knowledge out of your agent with a call. Today the ability to seek out the fundamentals you prefer inside businesses is readily available with a simple mouse click.

When you discover a stock with all the current attribute of a company you'd like to trade, afterward you need certainly to place the trade. With on line trading not merely can you pay a diminished fee normally, nevertheless have many choices to select from whenever entering the trade.

How exactly to spot an internet stock trade

Initially, why don't we explore the 3 simplest-but most important-terms to understand before putting a trade on the web. You will see these terms each time you have a quote on a stock (or an option for that matter): final, Bid and inquire.

"Last" may be the price of the last trade that took place in the stock.

"Ask" may be the cheapest economy cost provided by a potential seller.

"Bid" may be the highest current market price made available from a possible buyer. (normally, the Ask is usually the greater price plus the Bid could be the lower price.)

Something an on-line stock order?

An internet stock order is a set of specific directions to buy or sell a certain protection. Instructions are registered on stock purchase admission. This order admission includes the activity, share quantity, icon, price and length.

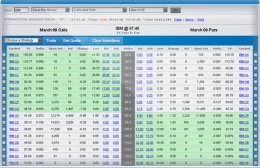

This is just what TradeKing's stock order entry screen seems like.

Initially, let us talk about the activity: Buy or offer.

Purchase - simply take cash from your account, acquisition stock in the great outdoors marketplace and place the stock within account.

Offer - Sell stock held within account on the open market and place the cash within account.

More key trading terminology

Shares: Enter the quantity of shares you want to trade. This should be a whole quantity, since the marketplace centers cannot take fractional share purchases.

Symbol: Here you may go into the trading symbol/ticker (usually letters) for an openly exchanged protection. Every safety has actually an alternate sequence of figures. Stocks traded and noted on U.S. exchanges as NYSE (ny stock-exchange) may be as much as 3 figures long. Stocks that trade in the Nasdaq marketplace usually have 4 figures.

So now you have to find the particular purchase you would like to enter. Here are some of the choices.

Market purchase: this can be a buy or offer purchase to be performed on most readily useful price currently available in the wild market. You will be guaranteed an instantaneous execution, although not a specific price. Once you enter a market order to purchase, you need to pay attention to the ask cost on your own stock estimate. If you are selling you ought to focus on the bid price. Since market order does not guarantee an amount, beware your price could relocate either direction before your order gets to the trading floor.

Limit purchase: For purchasers, this might be a purchase purchase stock at or below a specified cost. For vendors it's an order to market at or above a specified price (called the limit price). Limit orders will be executed only at a specified price, or if the price moves favorably for the buyer or seller, it will automatically be executed at the most advantageous price available.

Put another way, in the event that market is at a "better" cost available, after that your limitation purchase is performed at that "better" price. A typical example of a scenario if this might happen is if the stock spaces overnight and opens at a price much more beneficial to you as compared to cost specified in your limit order.

The tradeoff when it comes to price defense of a limitation order is the chance that it will not be performed if market does not reach finally your cost.

Stop Order: this will be market purchase to purchase or sell if a specified price (the end cost) is reached or passed away. Once the stop pricing is reached your order are performed "at market". A sell stop cost is going to be underneath the marketplace; a buy end price will likely be above the marketplace. Offer stops are the most frequent using this purchase kind. Your order is going to be registered after the stock was purchased utilizing the goal of selling the stock and avoiding losings if the market drops precipitously.

End Limit purchase: it is an order purchasing or offer a specific protection at a specified price or much better, but just after a specified cost (end price) has been reached. A stop-limit purchase is essentially a combination of an end purchase and a limit purchase.

Day purchase: a buy or offer purchase which immediately expires if it's not executed through that trading session. All marketplace instructions are immediately set-to Day.

GTC (Good ‘Til Canceled): an order to purchase or offer that stays open within account for 60 calendar days from original time put, unless executed or canceled. Modifications or edits to a GTC order cannot affect the original purchase date.

Various terms on Qualifiers

"Qualifiers" are optional directions you could add to a purchase.

AON (all-or-none): This stipulation on a purchase or offer order instructs the broker to either fill the entire purchase using the desired few stocks, if not never fill it whatsoever.

Just how to put an alternative purchase

From the time the Chicago Board solution Exchange (CBOE) launched their doors in 1973, options have cultivated exponentially in appeal. So today, it's easier than ever before for retail people to trade choices on the web.

Choices are contracts that provide the master the right to buy or sell a secured asset at a set price (called the "strike price") for a certain period of time. Owner of the option agreement must use the other side of the trade in the event that alternative owner exercises the right to buy or offer the asset.

There are two forms of choices: telephone calls and places. In the event that you purchase a telephone call, there is the to "call" the root stock away at the strike cost. In the event that you purchase a put, you have the directly to "put" stock to some one at the attack cost.

Entering an online option trade is quite just like entering an on-line stock trade, with a few key variations. It is just as simple to market options-without owning them-as it really is purchasing them regarding open-market. As a result of this once we enter on alternative purchase we have to include some more terms, and thus, there are some more terms we have to define.