Stocks to buy and sell quickly

Shares had been modestly higher early Thursday because they tried to bounce from a sell-off Wednesday. But Nvidia sold off again. (iStockphoto)

Shares had been modestly higher early Thursday because they tried to bounce from a sell-off Wednesday. But Nvidia sold off again. (iStockphoto)

A baseball or basketball group have trouble without an excellent protection. Also, earning profits in shares is challenging without an audio attempting to sell strategy.

Half the fight is purchasing the right stock at the correct time, but it is equally important understand when to offer — on upside plus the disadvantage.

Whether the stock didn't pan out the way you hoped or the market falls into a correction, you risk losing far more money if you don't have a set cutoff point at which to get out of a losing position.

That's why IBD often stresses the importance of the 7%-to-8percent sell guideline. If a stock drops 7per cent or 8% below your buy point — perhaps not its peak cost — exit the positioning without asking concerns. Do not let a little reduction spiral into a larger one.

"your whole secret to winning huge in currency markets isn't becoming appropriate all the time, but to lose the smallest amount of quantity feasible when you are incorrect, " founder and Chairman William O'Neil composed in "making Money in Stocks."

It is in addition crucial to take into account that occasionally you don't need to watch for a stock to-fall 7per cent to 8% from the entry before cutting it free. That rule of thumb could be the absolute restriction. Investors are in higher danger of losses once the marketplace uptrend is under pressure or perhaps in modification.

Then when the market is not in a verified uptrend and a stock you possess actually behaving well, it really is perfectly appropriate to leave of a position in front of a 7% to 8% decline. In cases like this, cut your losses at 3per cent to 5% to help protect your capital. Then you can put those resources working in better-performing shares or raise cash for the following uptrend.

Keeping mostly in money is sensible when the marketplace is in a steep correction or a bear market. When the marketplace is in an uptrend but trading is choppy, try to offer jobs at a straight lower threshold, perhaps at 2% or 3per cent underneath the buy point.

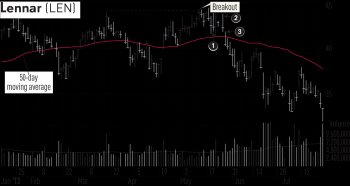

Take Lennar (LEN), like, in 2013. The homebuilder surfaced from a V-shaped cup base on March 20 in heavy amount. The following program, it pulled back into develop another comparable cup base. Lennar climbed past a new purchase point at 44 on May 14, but shut somewhat below it.

Take Lennar (LEN), like, in 2013. The homebuilder surfaced from a V-shaped cup base on March 20 in heavy amount. The following program, it pulled back into develop another comparable cup base. Lennar climbed past a new purchase point at 44 on May 14, but shut somewhat below it.

Lennar attempted to clear the entry, but reversed lower once striking intraday highs (1). then your stock dropped further in weightier trade. It fell over 5percent intraday through the purchase point, before settling for a 3.9% loss from 44 entry by might 22.

The stock staged a 3percent upside reversal in quick return a day later, though it neglected to reclaim its buy point. Lennar again fell up to 5per cent during a bearish reversal two sessions later (2).

That turned out to be the last-ditch chance to reduce losses short. On 29, the stock sank 4%, slicing its 50-day going average in heavy amount to fall more than 8per cent underneath the purchase point (3). After that, it dropped as much as 30% through the 44.40 peak to its mid-August minimum.

Along with a lack of upside amount, Lennar's general energy line (kindly visit a Marketsmith chart or IBD chart at Investors.com to begin to see the RS range, painted in blue) lagged because it attempted to use. Distribution times had already been mounting up on the market while Lennar had been focusing on both bases. Shortly after the stock's breakdown, the marketplace perspective changed to under pressure, and by mid-June to a correction.