Online penny stock trading

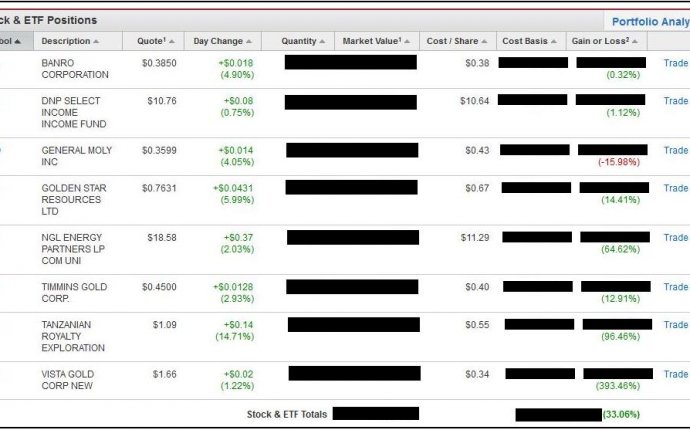

For most investors, an easy buy-and-hold profile of list funds may be the way to go. Many my personal profile, which I’ve already been managing for nearly 10 years today, is in stable and diversified opportunities such as these. But I’m also a little bit of an adrenaline junkie and geek-out on financial investment analysis, and so I enjoy investing in the high stakes world of little and low-priced businesses (a.k.a “penny shares”) with a small amount of money, also.

For most investors, an easy buy-and-hold profile of list funds may be the way to go. Many my personal profile, which I’ve already been managing for nearly 10 years today, is in stable and diversified opportunities such as these. But I’m also a little bit of an adrenaline junkie and geek-out on financial investment analysis, and so I enjoy investing in the high stakes world of little and low-priced businesses (a.k.a “penny shares”) with a small amount of money, also.

The simplest way to reduce from cent stock profits — irrespective of making bad positions — is spending unnecessarily high agent fees. The very best brokers for cent trading and investing don’t tack on any extra fees for trading a higher amount of inexpensive stocks.

Charles Schwab supplies the most reasonable penny stock prices of any broker. it is also a good platform to grow your portfolio away from small cap stocks, also. Its web educational resources are first rate, and it also provides 200 commission-free ETFs to assist you further increase your portfolio. E*Trade’s pricing framework becomes less costly than also Charles Schwab after 313 positions per quarter, however. If you’re a working trader and on a regular basis hit those figures, that'll be your absolute best option.

The straightforward Dollar’s Top Picks to get the best Penny Stock Brokers

We viewed all of the hidden fees or surcharges that many agents like to tack on to penny stock trades, and discovered the ones that had the absolute lowest rates available.

Best In General: Charles Schwab

Perfect for Active Traders: E*Trade

Not all the “penny stocks” trade for a penny a share. Some trade for only a little under a buck plus some also trade at under anything at a fractional value per share. But irrespective of specific price, any real cent stock is likely to be an ultra low-priced financial investment on a per share foundation.

You ought to maintain your expense per share as low as feasible to trade penny stocks effortlessly.

Let’s say you only have $500 to purchase small cap stocks. Theoretically, you can purchase 50, 000 shares of a stock coming in at 1 cent per share.

In rehearse, you can find going to be expenses to virtually any deal. Let’s state your agent charges ten dollars to place a buy purchase then another $10 to place a sell order. Minus those fees, you actually only have $480 to take a position.

And imagine if you will find extra $30 expenses certain to low-priced stocks because your broker is not extremely welcoming to hostile cent stock investors? Now your $500 features changed into $450.

In grand plan of things, $50 might not seem like a package breaker. But that’s actually 10per cent of one's preliminary $500 investment. And worse, that 10% is lost from the forward end. It could accumulate big-time in lost earnings.

Consider the following math based on a $500 initial financial investment:

| per cent PREMIUM

IN FEES |

ACTUAL

FINANCIAL INVESTMENT |

BALANCE UPON

100per cent RETURN |

ACTUAL

PROFIT $ |

ACTUAL

PROFIT % |

| 5% | $475 | $950 | $450 | 90% |

| 7percent | $465 | $930 | $430 | 86per cent |

| 10% | $900 | $400 | 80% | |

| 15% | $425 | $850 | $350 | 70% |

As you can plainly see, it is not just the lost money compliment of fees that matter, nevertheless the lost financial investment profits, as you can’t put that cash to work in the stock exchange after your agent takes a cut.

What Makes a Penny Stock Broker?

There’s constantly threat to trading stocks, and lots of the big aspects that can cause a large move for the market or an individual organization are not in your control.

The thing you can manage to some extent is agent fees.

That’s the reason why I read the terms and conditions associated with 10 most well known discount stock agents. Including my top pick platforms, Charles Schwab and E*Trade, I explored:

- TradeKing

- Scottrade

- TD Ameritrade

- OptionsXpress

- Lightspeed

- Interactive Brokers

- Merrill Edge

- Robinhood

Here’s the things I looked-for, especially:

No Surcharges for Low-Priced Stocks: numerous discount agents tout their “standard” transaction fees in marketing, but neglect to let you know there can be an extra expense to low-priced securities. Some agents charge a percentage regarding the complete trade price as well as others charge a fee per share. Anyway, you’re getting charged much more versus you'll for a typical blue chip stock like Apple Inc. or Wal-Mart Stores Inc. at standard rates.