Can you get rich from penny stocks?

He marketed items of his Halloween costumeBruggemann has become thinking about making money. In preschool their moms and dads dressed him up as a concession man for Halloween, that includes a tray carrying popcorn and candy. "He arrived house with money, but no candy, " recalls their mother, Lynn. Later he tried their fortune with a lemonade stand in front side of the house. "We’re on a cul-de-sac, therefore very little cars drop here. He performedn’t care. He waited for five hours to help make that dollar take place."

He marketed items of his Halloween costumeBruggemann has become thinking about making money. In preschool their moms and dads dressed him up as a concession man for Halloween, that includes a tray carrying popcorn and candy. "He arrived house with money, but no candy, " recalls their mother, Lynn. Later he tried their fortune with a lemonade stand in front side of the house. "We’re on a cul-de-sac, therefore very little cars drop here. He performedn’t care. He waited for five hours to help make that dollar take place."

He got work as a busboy at a nearby restaurant at 14 and worked weekends. He put his cash into a savings account, but ended up being unsatisfied using the paltry interest he obtained. Their grandfather encouraged him to try the stock exchange and his father, a former Wall Street investor, ultimately decided to work as the custodian for an Etrade account. "i usually speak about the glory times, therefore perhaps it applied off some, " said their dad John, a former vice-president at JP Morgan which done the ground of New York stock-exchange. But John never played the small cap stocks. "Never. Not my game. You might make money or lose cash really, very quickly."

A weakness for risky, high reward activitiesBruggemann, however, embraced the chaos. He was a fantasy football fanatic with a head for figures and an attention to information. He'd dabbled in activities wagering and online poker, engaging in difficulty with his moms and dads if they found it. For Bruggemann, for numerous others, very cheap stocks were another outlet for the dangerous reward seeking. "There is a lot of fraud and manipulation, most of them aren't genuine organizations, " he says. "It could be some body like you or we sitting right here saying we've a $5 million deal with Panasonic, whenever in reality that is not true." According to the SEC, penny stock scams have actually surged over the past couple of years. ACYD ended up being Bruggemann’s initially big trade. It’s a manufacturer of manufacturing quality wireless gear for municipal Wi-Fi systems. He had heard a conference call where in actuality the CEO revealed it could purchase back stocks for the company in an attempt to spur the price towards 1 penny a share. Four times later, Bruggemann accumulated a position of a number of million shares at price of about one-third of a penny each. Four days afterwards, the business officially revealed its share buyback system, plus the cost started initially to climb.

ACYD ended up being Bruggemann’s initially big trade. It’s a manufacturer of manufacturing quality wireless gear for municipal Wi-Fi systems. He had heard a conference call where in actuality the CEO revealed it could purchase back stocks for the company in an attempt to spur the price towards 1 penny a share. Four times later, Bruggemann accumulated a position of a number of million shares at price of about one-third of a penny each. Four days afterwards, the business officially revealed its share buyback system, plus the cost started initially to climb.

By March, ACYD ended up being down seriously to a penny, and today it sits at $.0036 a share, nearly wherever it had been whenever Bruggemann got begun. It’s a reminder to him that investing these types of volatile stocks is a dangerous online game. "i assume the guideline is, once you spend money on anything stock, expect you'll lose every buck you put in. So there is always that risk, " he told me. "There have been several times in which we place every buck I’ve had on the line, and fortunately it's resolved nearly every time." He stops, then corrects himself. "Every time! Otherwise I’d have nothing."

The Verge evaluated Bruggemann's trading records and bank statements for this piece. About half of their above $300, 000 originated from their ACYD trade. Others 1 / 2 originated from a huge selection of trades that netted him a lot lower amounts.

Despite his powerful comes back, professionals assert, usually do not indicate he’s got some key formula to achieve your goals. "smart phones have exacerbated the monkeys and typewriters problem, " states Paul Kedrosky, a veteran investor. "provided adequate individuals with smart phones, a teenager from nj will change their club mitzvah money into 0, 000, strictly by possibility."

"It really is bullshit.Trust in me."

Bruggemann’s personal success seems to be equal parts chance and effort; a mixture of diligent analysis, tolerance for danger, while the discipline to get out rapidly to limit his losses. It’s well worth noting that he’s only already been investing for about 17 months. And it helped, needless to say, those months were held over the last year and one half, whilst stock exchange had been climbing to brand-new highs.

Bruggemann’s personal success seems to be equal parts chance and effort; a mixture of diligent analysis, tolerance for danger, while the discipline to get out rapidly to limit his losses. It’s well worth noting that he’s only already been investing for about 17 months. And it helped, needless to say, those months were held over the last year and one half, whilst stock exchange had been climbing to brand-new highs.

Like gambling at a casino, the odds whenever playing small cap stocks tend to be piled against you. The high degrees of fraud and volatility indicate it's very difficult to anticipate what is coming. Connor's staggering success, state experienced dealers, is certainly not a magic strategy other individuals could replicate. Indeed, numerous We talked to doubted it had been real whatsoever.

"there are not any prodigies, simply bull areas, " says Howard Lindzon, a buyer and president of Stocktwits. He encouraged myself not to cover Bruggemann’s tale. Various other dealers I chatted to had been much harsher. "It's bullshit. Trust in me, " said one. "this really is becoming orchestrated by a cent stock alerts item; it is an advertising con."

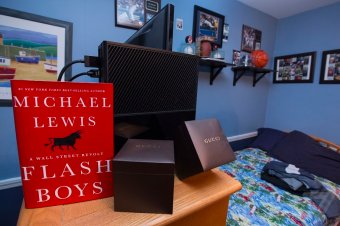

In the home, in a space he shares along with his older cousin, Bruggemann has two tracks set-up as a trading place. But most of the time, he tells me, "I like to trade on my phone." He monitors positions making use of something called Level2, which shows him who the client and vendors tend to be, exactly what prices they’re requesting, and how numerous stocks they hold. He also consults the chat room, that he runs, as well as other discussion boards he either operates or frequents. Eventually he's the Etrade application, in which he really executes all his buy and sell instructions. "In school they will have lots of things blocked, Java is blocked, and so I use my iPhone rather."

"we said you almost certainly simply price him money."Bruggemann has received their phone confiscated a few times, leading the college to get hold of their moms and dads. "a year ago I got a telephone call from the school saying the physics teacher took away Connor’s mobile phone and today I have to come and pick it up, " stated their mommy. Bruggemann bought himself a unique BMW together with profits, a unique Macbook for each of his moms and dads to their birthdays, and iPads for their siblings. "I inquired just what time performed this take place, and she said 9:35. I said you almost certainly simply price him money. He trades shares, 9:35 means the marketplace just unsealed, he'd to make a move. They said he’s in physics class, he can’t do that, and I’m like, ok, whatever."

Bruggemann has actually put on college and hopes to study finance, economics, and entrepreneurship. But he's in addition cooked-up his own guidance web site, in which users can discover their trading tricks and tips, follow along with his performs, and converse in an exclusive talk area with Bruggemann and a few other traders, all for the good deal of simply $2, 000 annually. This can be probably in which their connection with penny stocks borders many in the unscrupulous side. Bruggemann is a huge lover of Tim Sykes, an old whiz-kid himself, just who guarantees in order to make his consumers abundant with only seven days. Your website Bruggeman is working doesn’t make any outlandish statements, but he’s nevertheless peddling the concept that he has actually a unique skillset other individuals may use to their benefit trading very cheap stocks, a promise that could be difficult to keep.

Whilst the promises on Bruggeman’s web site tend to be less intense than "Get rich quick" systems like Sykes', there was some self-interest in generating a wristwatch listing of very cheap stocks. "If someone could pay me personally for what I’m trading, we don’t need in at a cent and be in at a cent . 5." Suggesting stocks you currently get without disclosing that simple truth is at the heart of numerous penny stock schemes.