Everything about stocks

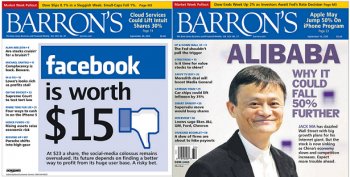

Source: Barron's

Source: Barron's

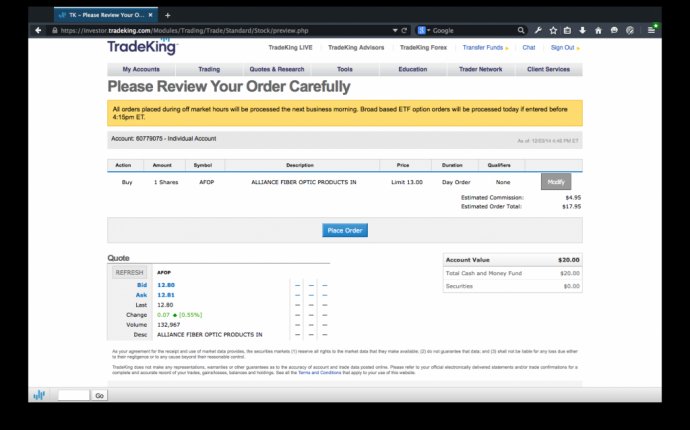

Many individuals fall short of what they want to quickly attain within the investing world for their not enough discipline and patience. Investors have become much more focused on short term comes back. If there's a time period of stock market underperformance, they desire no part of it. They grow fearful that their profits are lost.

The typical holding duration throughout the currency markets features greatly fallen over the years considering short-termism. Nonetheless it could become a pricey. A higher turnover rate have an adverse impact on your comes back through bad marketplace time and increasing exchange prices. We firmly think that keeping invested for the lasting and through bad times can create superior wide range.

Jon Boorman, a profile supervisor at Broadsword Capital, developed the chart below to exhibit united states a few of the crazy stock market punditry since 2010. The most effective people (e.g. Warren Buffett, Peter Lynch) prevented doom-and-gloom calls and instead focused their particular time and effort to find great organizations to park their particular money. But the same can't be stated about your normal mother and pop music investor. They truly are much more at risk of marketplace crash predictions, that could lead to emotional, and expensive investing decisions (i.e. attempting to sell their particular long-term assets).

My guidance: overlook the noise!

If you can't stomach the volatility of this currency markets possibly spending is just too stressful for your needs. If you're able to take the day-to-day swings for the market, you are going to do good within the long-lasting, as shares always rebound after ugly modifications. The monetary turmoil in Asia previously this year, additionally the Brexit vote in July, added to remarkable sell-offs in global equity markets. These days, the Dow and S&P 500 (NYSEARCA:SPY) tend to be making brand-new highs.

During nasty sell-off in January, I inquired David Baskin, president of Baskin Wealth control, what he'd tell their consumers during bad times. He replied, "1. You own good names. 2. cannot confuse trading with investing. 3. Value is acknowledged in the long run. 4. This too shall pass."

I truly liked his self-explanatory response. If you spend money on great companies in stable sectors that create recurring profits and cash flows, then the best reaction to short term volatility has been doing nothing. If markets are going wild, show patience and self-disciplined because this also shall pass. There will be, definitely, often where you will have to make a selling choice.

I believe selling a business simply by looking at the stock price is a bad idea. As an alternative, you ought to offer the stock if company is experiencing deteriorating fundamentals, neglecting to adjust to switching business styles, or mismanagement of capital. They're good reasons why you should disappear from an investment, but offering the stock because of underperformance? Not so much.

Supply: CNBC

You are going to usually review articles inside economic portion of a paper or mag caution investors of next market failure or just how a certain company is in relation to failure. Learn how to block the market noise, do your personal research, while making investment choices that are best for your needs. You may end up selling a beneficial company at a bottom in the place of purchasing more of it (dollar price averaging). For instance, if you implemented Barron's advice on Twitter (NASDAQ:FB) and Alibaba (NYSE:BABA), son do you get that one incorrect.

Consider an extensive market sell-off as a big snowfall storm. It's bad initially, but every little thing in the course of time clears up-and extends back to normalcy.

This is what I'm reading:

Disclosure: I/we have no roles in virtually any shares pointed out, no plans to start any opportunities next 72 hours.

We penned this informative article myself, therefore expresses my very own views. I am not getting settlement because of it (besides from Pursuing Alpha). I've no business model with any business whoever stock is mentioned in this article.