All about stock Exchange

Inventory exchanges tend to be progressively leaving the trading business.

As weird as it may seem, specific shares not any longer will be the many definitely exchanged securities in the market. That distinction goes to exchange-traded resources, which took in an archive $400-billion in past times year to become a $3.8-trillion business.

“that which we tend to be witnessing is investors tend to be progressively utilizing ETFs as an alternative for specific shares, ” said Todd Rosenbluth, director of ETF and mutual resources at CFRA, an unbiased research provider. “That happened in 2016 and it’s gonna carry on in 2017 and beyond.”

Daily, a huge most investments are in ETFs, like the SPDR Financial choose Sector Fund, or XLF, with a typical day-to-day amount of 105 million stocks, rendering it fifth-most traded fund. That’s 24 per cent over the second-most traded stock, Chesapeake Energy Corp. of 15 most greatly traded securities in 2016, just three had been shares, based on volume information compiled by Credit Suisse Group AG.

The developing heft of this services and products comes because the number of brand new U.S. listed businesses diminishes quite a bit. Meanwhile, there are nearly 2, 000 ETF directories, an all-time high, Credit Suisse data program.

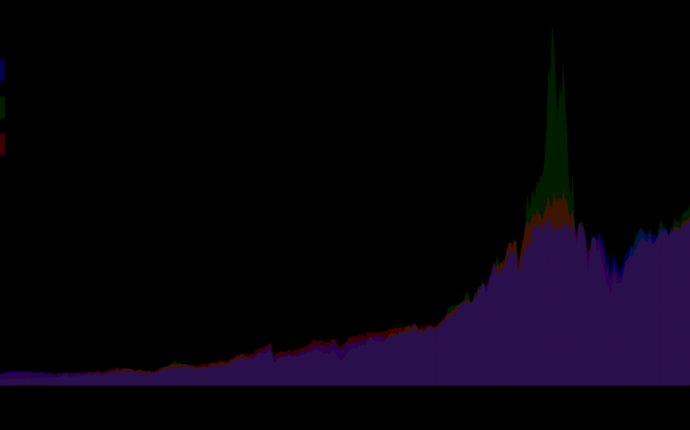

In fact, day-to-day amount has increased among both ETFs and shares, although development hasn’t been equal. ETF amount rose 50 per cent during the last couple of years, compared to 7 per cent for specific shares, in accordance with Credit Suisse. They note that most of the gains attended from non-equity funds, such as commodity-based ETFs, that have seen amount balloon a lot more than 170 per cent since 2014.

“There’s been a shift to passive management, and people like indexing, ” Ana Avramovic, a U.S. strategist at Credit Suisse, said by phone. “The primary thing is the fact that the other asset courses are really operating many this development.”

‘Worse Than Marxism’

To be certain, whenever assessed by U.S. buck amount more stocks fall inside the top - some volatility products that are designed to-be traded intraday at a low cost, which overstates their value. Nevertheless, almost 50 % of the very best 20 traded securities by price tend to be ETFs, like the top two, based on Eric Balchunas, ETF analyst at Bloomberg Intelligence.

Having said that, the most-traded security is a stock: 108 million shares of Bank of The united states Corp. change on the job average per day, Credit Suisse found. Directly behind is the SPDR S&P 500 ETF, or SPY, with 105 million shares an average of. But Bank of America does not have much business as only two various other stocks tend to be among the 15 many exchanged securities, Chesapeake and Sirius XM Holdings Inc.

These numbers have actually fueled criticism from active managers like Sanford C. Bernstein & Co., which noted that passive investing is “worse than Marxism.” Goldman Sachs Group Inc. echoed an equivalent sentiment, arguing that ETFs as well as other passive automobiles increase the possibility that equity stocks move around in combination. But obviously Goldman provides its own collection of ETFs, that have a combined $2.9 billion in possessions under management.

Credit Suisse’s Avramovic dismisses Goldman’s criticism, noting that the lion’s share of ETF expansion has actuallyn’t originate from shares but instead from products associated with commodities and volatility steps, for instance the Chicago Board Alternatives Exchange SPX Volatility Index, or VIX. Due to the fact ETF market matures, these places will end up a larger slice of the pie.

“To be clear, equity ETFs nevertheless take into account the bulk of ETF trading, ” she wrote within the report, “but the rise is coming from ETFs on various other asset classes.”