Want to learn about stock market

As numerous visitors know, each long or brief “leg” of the preferred long/short aspect profiles is usually built by ranking stocks using one certain characteristic (value, momentum, or volatility).

For instance, take the Fama French 3-factor design. Very first, it depends on HML (the value element), which is the extra comes back of worth shares over development shares (size-adjusted). 2nd, it uses SMB (the size element), that will be simply the excess return of tiny limits over large limits (value-adjusted). The 3rd aspect is market risk, or “beta.” Observed excess returns (for example., comes back far above the risk-free rate) can often be explained whenever one settings for those element traits.

However, not one of those single mispricing factors (i.e. HML, SMB, MOM) can accommodate a sizable pair of anomalies very well. Once you glance at a bigger set of anomalies, such as for instance 30 or 50 or even more anomalies, designs including the Fama French 3-factor design, do not have a good ability to give an explanation for larger few anomalies analyzed. Of course, this isn't always too surprising since anomalies are usually just considered “anomolous” once it really is determined that FF 3-factor model can’t explain the excess comes back linked to the method that creates the anomaly.

Stambaugh and Yuan (2015) state they may be able resolve this issue by making two composite elements, every one of which is comprised of groups of anomalies being just like and better express the single-characteristic elements inside parsimonious designs.

Therefore the key difference is:

“Rather than have each element match one anomaly, as is typical, we build factors by incorporating stocks’ ratings regarding 11 prominent anomalies.”

** These 11 prominent anomalies are: net stock issues, composite equity problems, accruals, web working possessions, asset development, investment to possessions, stress, O-score, momentum, gross profitability, and get back on possessions.

After that, the authors combine these two brand new elements with marketplace and size factors, so that you can develop a new four-factor model. This model is shown to do a lot better than significant four- and five-factor option designs.

From paper:

As an example, when placed on the 51 of these anomalies having information over our whole test duration, the Gibbons-Ross-Shanken (1989) test of whether all of the anomalies’ alphas equal zero produces a p-value of 0.10 for the design compared to 0.003 or less for those four- and five-factor alternate models.

Observe that a Gibbons-Ross-Shanken test has actually as a null theory there is no alpha of these anomalies. If you discover alpha, the design isn't doing an excellent work.

Mispricing aspects: UMO (underpriced minus overpriced)

It is a complex process to make the mispricing facets. Below we simplify some crucial tips:

- Step 1: split the 11 anomalies into two clusters utilizing a correlation-based distance dimension and a clustering technique.

- Step 2: Average a stock’s ranks with anomaly measures within all the two clusters. Therefore, every month, a stock features two composite mispricing steps, P1 and P2.

- Step 3: Construct a UMO1 (underpriced minus overpriced) factor: the paper defines UMO1 as “value-weighted comes back on each of the four profiles formed because of the intersection regarding the two size groups using the top and bottom groups for P1. UMO2, is likewise constructed from the lower- and high-P2 profiles.”

Then paper combines the 2 mispricing aspects with market and dimensions elements to create a four-factor design. (This report in addition constructs its own dimensions element in place of utilize the FF size aspect. Try it out if you are interested).

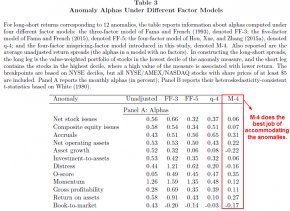

The authors after that run a horse-race contrast among four aspect models:

- FF-3: three-factor type of Fama and French (1993)

- FF-5: five-factor model of Fama and French (2015)

- q-4: four-factor “q-factor” style of Hou, Xue, and Zhang (2015a)

- M-4: four-factor mispricing-factor design introduced inside report

The outcomes from dining table 3 demonstrate that the M-4 model performs better and accommodates a broader array of anomalies than both FF-5 and q-4 designs. Particularly, eight out from the nine positive M-4 alphas are below the matching alphas the various other models.

Also, whenever we exchange both mispricing aspects with one composite mispricing factor that just averages ratings across the entire 11 anomalies, the next 3-factor model outperforms the FF-3.

the outcome are hypothetical outcomes and are NOT an indicator of future outcomes and don't express comes back that any buyer in fact acquired. Indexes tend to be unmanaged, do not mirror administration or trading costs, and one cannot invest directly in an index. Extra information in connection with building of these outcomes is available upon request.

the outcome are hypothetical outcomes and are NOT an indicator of future outcomes and don't express comes back that any buyer in fact acquired. Indexes tend to be unmanaged, do not mirror administration or trading costs, and one cannot invest directly in an index. Extra information in connection with building of these outcomes is available upon request.

Maybe this can ben’t astonishing, considering that the aspect design accustomed “control” when it comes to anomalies is built using the anomalies (the same review can probably be said the various other aspect models–e.g., worth washes away when you control for HML). However, the writers do examine a larger collection of 73 anomalies and program that their element model works better than many other aspect designs. Pretty cool.

At a minimum, for scientists seeking to recognize “new” some ideas, this factor design is a great tool. If one identifies a substantial “alpha” after managing for Stambaugh and Yuan 4 element design, there was a good chance there could be something unique linked to the method under analysis. Eventually, it is a 93-page beast on every thing “factor” associated. If you felt like geeking out on the week-end, this is an excellent starting point!

Abstract:

A four-factor design with two “mispricing” facets, in addition to market and size elements, accommodates a sizable group of anomalies better than significant four- and five-factor alternative designs. More over, our dimensions element shows a small-firm advanced nearly two times usual quotes. The mispricing aspects aggregate information across 11 prominent anomalies by averaging positioning within two clusters exhibiting the best co-movement in long-short comes back. Buyer sentiment predicts the mispricing factors, particularly their quick feet, consistent with a mispricing explanation plus the asymmetry in easier purchasing versus shorting. Changing book-to-market with one composite mispricing factor creates a better-performing three-factor design.

Note: this website provides no information about our price spending ETFs or our energy investing ETFs. Please relate to this web site.

Kindly understand that past overall performance is not an indication of future outcomes. Kindly read our full disclaimer. The views and opinions expressed herein are the ones regarding the writer nor always reflect the views of Alpha Architect, its affiliates or its staff members. This product has-been offered for you exclusively for information and educational functions and will not represent an offer or solicitation of an offer or any guidance or suggestion purchasing any securities or any other economic instruments and could not be construed therefore. The factual information set forth herein has been acquired or produced by sources believed because of the writer and Alpha Architect becoming trustworthy however it is not necessarily all-inclusive and is maybe not assured as to its accuracy and it is never to be considered a representation or guarantee, express or implied, as to the information’s reliability or completeness, nor should the connected information serve as the cornerstone of every investment decision. No section of this product is reproduced in any type, or labeled in any other publication, without express written permission from Alpha Architect.